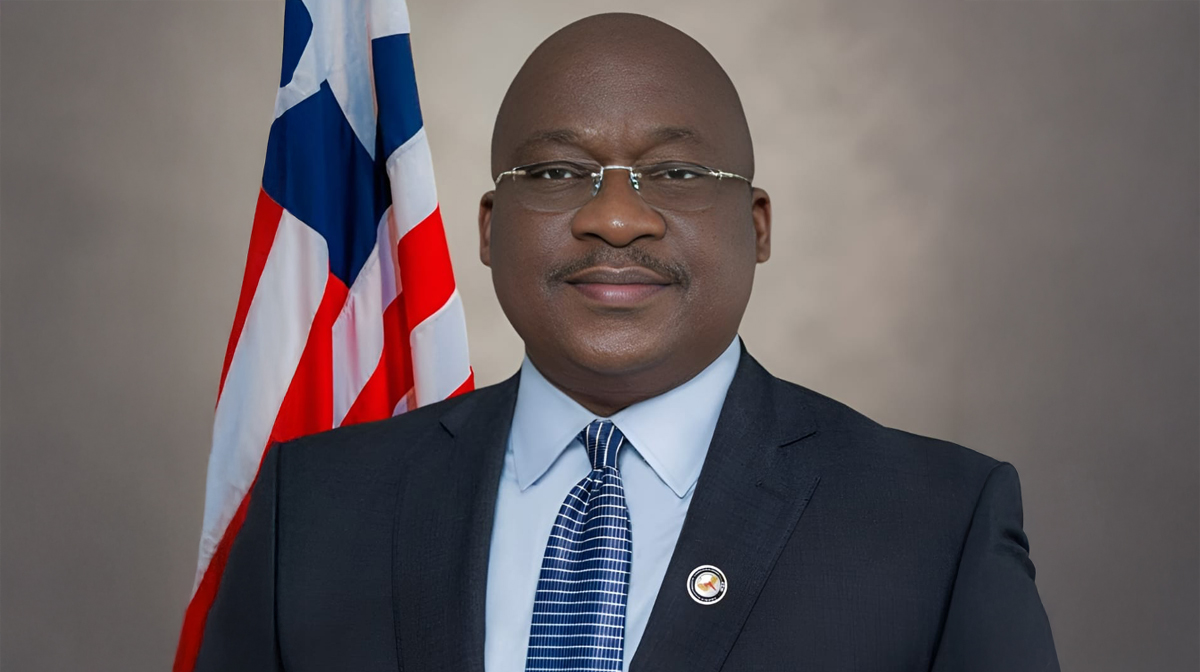

29 Jan Interview with Hon. Mohammed M. Sherif, MD & CEO of Liberia Electricity Corporation (LEC), Liberia

As the newly appointed CEO of LEC, what is your strategic vision for the Corporation’s role in Liberia’s power sector, and what key priorities will guide your efforts over the next year?

I envision a Liberia where every business can access reliable, affordable and sustainable electricity within the next four to five years. To get there, LEC is prioritizing loss reduction, both technical and commercial, which currently stands at about 44%. We are also improving operational efficiency to rebuild public confidence and position LEC as a commercially viable, customer-centric and digitally enabled utility.

This means shifting from reactive maintenance to predictive, technology-driven solutions so we can respond to issues in real time and prevent outages before they occur. Ultimately, my goal is for LEC to stand on its own feet financially, contribute to government revenue, and help drive Liberia’s economic growth.

How do you assess the current state of the electricity and energy sector, and where do you see the key challenges and opportunities?

When we assumed leadership in April, we conducted a full assessment across the value chain – generation, transmission, distribution, commercial and corporate services. Two challenges stood out: high losses and limited financing, both of which constrain grid upgrades and expansion.

To address this, we’re implementing an aggressive loss-reduction and efficiency plan. With demand expected to rise from 130 MW to 400–500 MW over the next five years, there are major opportunities for independent power producers, especially to serve large users like mining companies.

We are working with the Ministry of Mines and Energy, the Ministry of Finance, the Public Procurement Commission and the National Investment Commission to establish a PPP framework that ensures investors can recover their costs. For example, mining companies – our anchor customers – spend heavily on private generation today. By connecting them to the national grid and using escrow mechanisms, IPPs can receive payments directly, LEC earns its margin, and investors gain confidence.

The PPP policy we’re finalizing will make LEC’s grid the primary supplier, with private generation serving only as backup. This structure provides security for private investment while strengthening the national grid.

With major investments underway, including the EU-backed €107 million package, which projects and initiatives are you prioritizing to strengthen the grid, expand access and ensure sustainable growth?

LEC has several major initiatives underway with our multilateral partners. The World Bank is financing the Liberia Energy Efficiency and Access Project (LEEAP) to expand connections beyond Monrovia, while the EU is supporting grid consolidation in Monrovia and Grand Bassa. The African Development Bank is assisting with rural electrification and regional transmission projects.

We’re working with private investors to modernize substations and upgrade transmission lines from Mount Coffee hydropower, which will allow us to move more power into Monrovia and surrounding counties.

On generation, we are partnering with Energy America on a 100 MW solar project with battery storage – scalable up to 1,000 MW. CCECC is adding 50 MW immediately and another 100 MW in the dry season. We’re also advancing a 190 MW hydro project on the St. John River, ultimately reaching 400 MW. Together, these projects will add nearly 600 MW of new capacity.

To close the rural–urban access gap, we’re using the CLSG regional transmission line as our backbone to connect counties like Nimba and Bong, and the Saudi Fund is supporting the extension to Lofa. Across all initiatives, the goal is clear: raise national access from 33% to 75% by 2030 and connect 60,000 new customers through our Mission 300 program.

Which renewable sources hold the greatest potential for Liberia’s energy future, and what role can international partners play in accelerating this transition?

Our energy mix is still dominated by hydropower, which provides close to 60% of our current generation. We also operate thermal plants, but our strategy is to steadily reduce reliance on fossil fuels and transition toward renewables, particularly solar PV. This shift opens fast-track investment opportunities in both hydro and solar, while the role of thermal generation continues to decline.

What kinds of partnerships is LEC seeking with international investors, and where do you see the strongest opportunities for American companies in Liberia’s power sector?

We are already partnering with Energy America in Houston, which is financing its projects through a mix of 30% equity and 100% debt via the Exit Bank. We are also working closely with MCC and engaging development finance institutions to attract more U.S. investors. Historically, most foreign participation came from Europe and Asia, so we are strongly encouraging American firms to enter the market. We ensure investors have secure frameworks that guarantee they can confidently recoup their investment.

What is your message to USA Today readers about choosing Liberia as their next business and investment destination?

Liberia is a land of opportunity. Liberians are open-minded, welcoming and committed to ensuring investors receive real value. The energy sector, in particular, offers vast potential – especially in generation – as demand is expected to grow by more than 300% over the next five years. Investors should also consider the regional market: through the CLSG line, Liberia is connected to Sierra Leone, Guinea and Côte d’Ivoire, enabling power exports across the region. Beyond generation, there are major opportunities in modernizing transmission, distribution and commercial services. We welcome U.S. and international investors to explore the full value chain – there is tremendous room to grow.